Enjoy The Benefits Of A Tax-Free Retirement With Accel

Let our team of professionals help you with all of your retirement related matters. Book a free appointment today.

Everything accounted for

No risks! We make sure that we take care of everything the right way.

Fully Protected

Your investment will be protected by us so you can retire with financial freedom.

Assurance

Our team will always be there for you to answer your questions.

About Company

Tax-free retirement made easy by Accel

Accel Financial Partners has years of experience and many successful cases of helping people achieve financial freedom.

Easy Process

How it works

First Step

Second Step

Third Step

Consultation

Book a free consult call with one of our team members today!

Application process

Our team processes your application in no time!

Delivery

Congratulations! You have achieved financial freedom.

We provide the best service when it comes to tax-free retirement.

Testimonial

Our Clients Reviews

I was able to have my application processed by them very quickly and they took care of everyhting. Great service.

Jane Doe

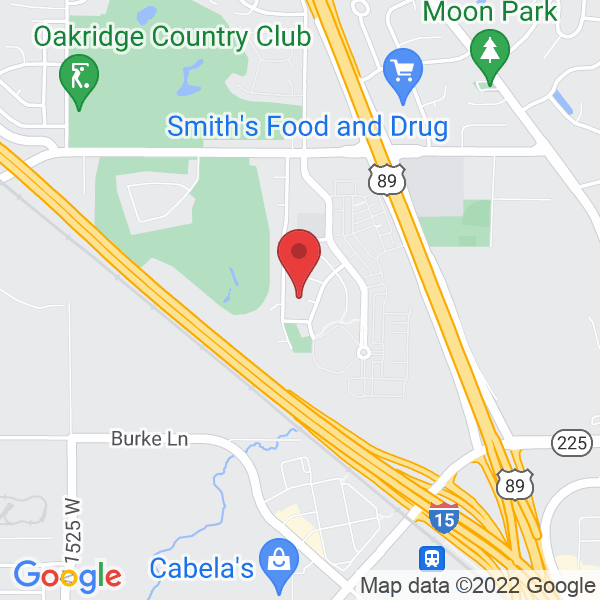

Office: 1073 Aberdeen Circle, Farmington UT 84025

Call (801) 860-5448

Email: taylor@accelfp.com